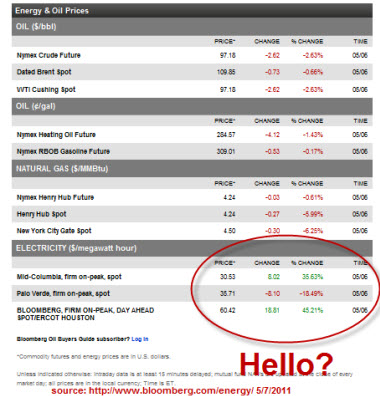

Oil prices dropping 15% in a week is pretty bananas really. That’s the headline we’re seeing as oil futures dropped 8.6% in a day. That’s pretty significant, but let’s face it – gas prices at the pump do this all the time. Only they tend to rocket upwards rather than down.

So why the sudden drop?

“Don’t blame OPEC, blame the traders and the rumor mill,” said a prominent propagandist and oil market impresario. The upshot of a long winded press statement explained that those computerized high frequency speculators caused a series of flash crashes. Which is utter bunkum really. I think that’s called in technical terms “what markets do”.

The statement explained that speculators have stop limits – orders which come into effect if the price crosses a threshold. So say oil was at $106 and a speculator (not an investor, speculators are a dirty breed which represent all that’s wrong in the world. Heck they’re not even people any more. It’s all ‘puters. Investors are the altruistic saints who generously capitalize the world by comparison) decides that if it goes below $104.50 then it will sell (speculators don’t have gender, they are alien fiends set to wreak havoc on the world).

Some bogus rumor is started about OPEC increasing oil supply, and prices go down. The first speculator’s limit of $104.50 is reached so it sells, lowering the price. The next speculator’s limit is reached. Sell. Lowers price. Rinse, repeat. Crash. Burn.

Um, hello. These stop limit orders aren’t anything new. And selling when things are falling below a certain level is just what happens – not just because baby-eating speculators are out to piddle in your market’s swimming pool. Markets with their not so perfect information are undulating beasts. The tide just happens to be going out at the same time a wave passes.

Cheap oil. Yay! Let’s build bigger cars. Will this have any impact on gas prices? Nah. They’ll stay high. Sorry. And you know who’s to blame? It’s the speculators.

Here’s an interesting fact about American oil supply and demand. America uses a quarter of the world’s oil, and has only 2% of its reserves. The argument goes that drilling for more oil in the US is going to have little effect on the gas or oil prices domestically – it’s like one cough in a whole hospital of retired cigarette testers.

So if you’re going to drive your car, gas prices are going to be high. The best thing to do in my opinion is speculate in the market a little, make some cash and build an electric car. I’ve got a nice Subaru Brat that would make a good target for a power plant transplant. Plenty of room in the bed for batteries – which reminds me, it’s my fifth second wedding anniversary today.