From time to time I need to send money from the UK to the US, and now that the dollar is stronger, back from the US to the UK. By pure coincidence today I happened to buy something from the UK with my US credit card the same day I moved US Dollars to GB Pounds with CurrencyFair.

Look at the difference in rates. Remember higher is better 😉

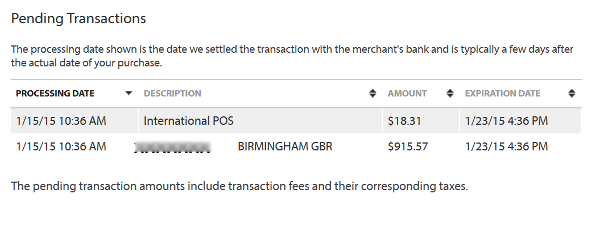

Credit Card: I bought something in a UK store for £599.63.

You can see my credit card bill here

So you can see that including the International POS (Please Our Shareholders?) charge of $18.31, the total cost in dollars is $933.88. This implies a dollar to pound rate of exchange of

0.6421 USD-GBP (Credit Card)

This is the trade I made in CurrencyFair’s platform. It allowed me to set my own rate, which then found a matching order in their peer-to-peer exchange operation.

So you don’t have to be Warren Buffet to realize that the exchange rate of 0.656 USD-GBP is much better. True, there’s a 3 GBP charge to transfer money out of the platform, so taking that expense into account, the exchange rate would be

0.6553 USD-GBP (CurrencyFair)

The other glaringly obvious thing is that the exchange rate is explicit and not handled by a credit card company or bank trying to squeeze a little out of the transaction.

That’s all well and good, but is it worth the effort?

If you transfer money or buy things overseas with any great regularity, I would always go with an explicit exchange rate over allowing the back office of a bank to take care of it. For my $4000 example above if I’d have paid for the $4000 item in the UK with my credit card, I would be $52.66 worse off than by using CurrencyFair. That’s 1.3% worse off if I didn’t.

So yes, I would say it is worth the effort, and I’ll be using CurrencyFair.com again (and if you click on the link here, you get to get a free transfer saving the three quid I was talking about)